Inglês

Exibindo questões de 701 a 800.

Argentina’s creditors, as the second paragraph shows, (A) - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

A última frase do texto 1 “This report will inform the - FAMERP 2015

Inglês - 2015Leia os textos 1 e 2 para responder à questão:

Texto 1

Call to halve target for added sugar

People need to more than halve their intake of added sugar to tackle the obesity crisis, according to scientific advice for the government in England.

A report by the Scientific Advisory Committee on Nutrition

(SACN) says sugar added to food or naturally present in fruit juice and honey should account for 5% of energy intake.

Many fail to meet the old 10% target. The sugar industry said “demonizing one ingredient” would not “solve the obesity epidemic”.

The body reviewed 600 scientific studies on the evidence of carbohydrates – including sugar – on health to develop the new recommendations. One 330ml can of soft drink would take a typical adult up to the proposed 5% daily allowance, without factoring in sugar from any other source.

Prof Ian MacDonald, chairman of the SACN working group on carbohydrates, said: “The evidence that we have analyzed shows quite clearly that high free sugars intake in adults is associated with increased energy intake and obesity. There is also an association between sugar-sweetened beverages and type-2 diabetes. In children there is clear demonstration that sugar-sweetened beverages are associated with obesity. By reducing it to 5% you would reduce the risk of all of those things, the challenge will be to get there.”

The target of 5% of energy intake from free sugars amounts to 25g for women (five to six teaspoons) and 35g (seven to eight teaspoons) for men, based on the average diet.

Public Health Minister for England, Jane Ellison, said: “We know eating too much sugar can have a significant impact on health, and this advice confirms that. We want to help people make healthier choices and get the nation into healthy habits for life. This report will inform the important debate taking place about sugar.”

(www.bbc.com. Adaptado.)

Texto 2

Eating more fruits and veggies won’t make you lose weight

We’re often told to eat more fruits and vegetables, but the chances that you’ll lose weight just by eating more of these foods are slim. New research suggests increased fruit and vegetable intake is only effective for weight loss if you make an effort to reduce your calorie intake overall. In other words, you need to exercise or consume fewer calories to shed those pounds. Don’t let that stop you from including more fruits and veggies in your diet, though. Even if they don’t directly help you lose weight, these foods still provide a number of health benefits.

In the excerpt from the end of the second paragraph – - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

No trecho do primeiro parágrafo do texto 2 “the chances - FAMERP 2015

Inglês - 2015Leia os textos 1 e 2 para responder à questão:

Texto 1

Call to halve target for added sugar

People need to more than halve their intake of added sugar to tackle the obesity crisis, according to scientific advice for the government in England.

A report by the Scientific Advisory Committee on Nutrition

(SACN) says sugar added to food or naturally present in fruit juice and honey should account for 5% of energy intake.

Many fail to meet the old 10% target. The sugar industry said “demonizing one ingredient” would not “solve the obesity epidemic”.

The body reviewed 600 scientific studies on the evidence of carbohydrates – including sugar – on health to develop the new recommendations. One 330ml can of soft drink would take a typical adult up to the proposed 5% daily allowance, without factoring in sugar from any other source.

Prof Ian MacDonald, chairman of the SACN working group on carbohydrates, said: “The evidence that we have analyzed shows quite clearly that high free sugars intake in adults is associated with increased energy intake and obesity. There is also an association between sugar-sweetened beverages and type-2 diabetes. In children there is clear demonstration that sugar-sweetened beverages are associated with obesity. By reducing it to 5% you would reduce the risk of all of those things, the challenge will be to get there.”

The target of 5% of energy intake from free sugars amounts to 25g for women (five to six teaspoons) and 35g (seven to eight teaspoons) for men, based on the average diet.

Public Health Minister for England, Jane Ellison, said: “We know eating too much sugar can have a significant impact on health, and this advice confirms that. We want to help people make healthier choices and get the nation into healthy habits for life. This report will inform the important debate taking place about sugar.”

(www.bbc.com. Adaptado.)

Texto 2

Eating more fruits and veggies won’t make you lose weight

We’re often told to eat more fruits and vegetables, but the chances that you’ll lose weight just by eating more of these foods are slim. New research suggests increased fruit and vegetable intake is only effective for weight loss if you make an effort to reduce your calorie intake overall. In other words, you need to exercise or consume fewer calories to shed those pounds. Don’t let that stop you from including more fruits and veggies in your diet, though. Even if they don’t directly help you lose weight, these foods still provide a number of health benefits.

We learn in the article, mostly in paragraphs two through - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

Argentina’s government argues that it can’t pay all - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

The fourth paragraph points out that (A) as Argentina - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

The excerpt from the fourth paragraph – had Argentina made - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

In its fifth paragraph, the article (A) backs up Ms - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

The word hers, as used in the second sentence of the fifth - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

According to the sixth paragraph, (A) there is still room - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

In the excerpt from the last paragraph – ... perceptions of - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

The last paragraph implies that (A) returning Repsol to its - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

In the last sentence of the text, the use of the phrase - FGV 2015

Inglês - 2015Read the text and answer the question

Argentina defaults – Eighth time unlucky

Cristina Fernández argues that her country’s latest default is different. She is missing the point.

Aug 2nd 2014

ARGENTINA’S first bond, issued in 1824, was supposed to have had a lifespan of 46 years. Less than four years later, the government defaulted. Resolving the ensuing stand-off with creditors took 29 years. Since then seven more defaults have followed, the most recent this week, when Argentina failed to make a payment on bonds issued as partial compensation to victims of the previous default, in 2001.

Most investors think they can see a pattern in all this, but Argentina’s president, Cristina Fernández de Kirchner, insists the latest default is not like the others. Her government, she points out, had transferred the full $539m it owed to the banks that administer the bonds. It is America’s courts (the bonds were issued under American law) that blocked the payment, at the behest of the tiny minority of owners of bonds from 2001 who did not accept the restructuring Argentina offered them in 2005 and again in 2010. These “hold-outs”, balking at the 65% haircut the restructuring entailed, not only persuaded a judge that they should be paid in full but also got him to freeze payments on the restructured bonds until Argentina coughs up.

Argentina claims that paying the hold-outs was impossible. It is not just that they are “vultures” as Argentine officials often put it, who bought the bonds for cents on the dollar after the previous default and are now holding those who accepted the restructuring (accounting for 93% of the debt) to ransom. The main problem is that a clause in the restructured bonds prohibits Argentina from offering the hold-outs better terms without paying everyone else the same. Since it cannot afford to do that, it says it had no choice but to default.

Yet it is not certain that the clause requiring equal treatment of all bondholders would have applied, given that Argentina would not have been paying the hold-outs voluntarily, but on the courts’ orders. Moreover, some owners of the restructured bonds had agreed to waive their rights; had Argentina made a concerted effort to persuade the remainder to do the same, it might have succeeded. Lawyers and bankers have suggested various ways around the clause in question, which expires at the end of the year. But Argentina’s government was slow to consider these options or negotiate with the hold-outs, hiding instead behind indignant nationalism.

Ms Fernández is right that the consequences of America’s court rulings have been perverse, unleashing a big financial dispute in an attempt to solve a relatively small one. But hers is not the first government to be hit with an awkward verdict. Instead of railing against it, she should have tried to minimise the harm it did. Defaulting has helped no one: none of the bondholders will now be paid, Argentina looks like a pariah again, and its economy will remain starved of loans and investment.

Happily, much of the damage can still be undone. It is not too late to strike a deal with the hold-outs or back an ostensibly private effort to buy out their claims. A quick fix would make it easier for Argentina to borrow again internationally. That, in turn, would speed development of big oil and gas deposits, the income from which could help ease its money troubles.

More important, it would help to change perceptions of Argentina as a financial rogue state. Over the past year or so Ms Fernández seems to have been trying to rehabilitate Argentina’s image and resuscitate its faltering economy. She settled financial disputes with government creditors and with Repsol, a Spanish oil firm whose Argentine assets she had expropriated in 2012. This week’s events have overshadowed all that. For its own sake, and everyone else’s, Argentina should hold its nose and do a deal with the hold-outs.

(http://www.economist.com/news/leaders/21610263. Adapted)

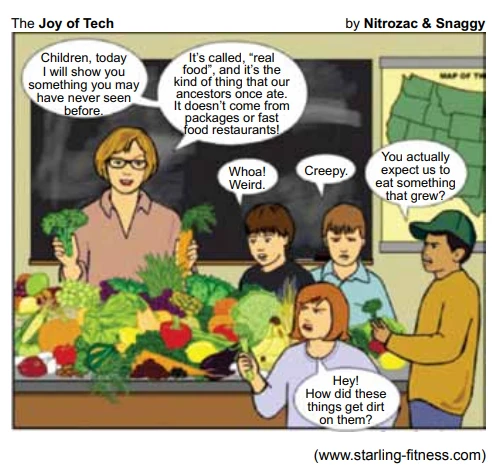

O quadrinho faz uma crítica a) à falta de bons modos - UNIFESP 2015

Inglês - 2015Examine o quadrinho para responder a questão.

According to the text, Mr Duncan Selbie concluded that - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

Every new piece of information about Britain’s weight problem makes for ever more depressing reading. Duncan Selbie, the Chief Executive of Public Health England, today tells us that by 2034 some six million Britons will suffer from diabetes. Of course, many people develop diabetes through no fault of their own. But Mr Selbie’s research concludes that if the levels of obesity returned to their 1994 levels, 1.7 million fewer people would suffer from the condition.

Given that fighting diabetes already drains the National Health Service (NHS) by more than £1.5 million, or 10 per cent of its budget for England, the impact upon the Treasury in 20 years’ time from unhealthy lifestyles could be catastrophic. Bad health not only impacts on the individual but also on the rest of the community. Diagnosis of the challenge is straightforward. The tougher question is what to do about reducing waistlines in a country where we traditionally do not like telling individuals what to do.

It is interesting to note that Mr Selbie does not ascribe to the Big Brother approach of ceaseless legislation and nannying. Rather, he is keen to promote choices – making the case passionately that people should be encouraged to embrace good health. One of his suggestions is that parents feed their children from smaller plates. That way the child can clear his or her plate, as ordered, without actually consuming too much. Like all good ideas, this is rooted in common sense.

(www.telegraph.co.uk. Adaptado.)

The excerpt from the first paragraph “many people - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

Every new piece of information about Britain’s weight problem makes for ever more depressing reading. Duncan Selbie, the Chief Executive of Public Health England, today tells us that by 2034 some six million Britons will suffer from diabetes. Of course, many people develop diabetes through no fault of their own. But Mr Selbie’s research concludes that if the levels of obesity returned to their 1994 levels, 1.7 million fewer people would suffer from the condition.

Given that fighting diabetes already drains the National Health Service (NHS) by more than £1.5 million, or 10 per cent of its budget for England, the impact upon the Treasury in 20 years’ time from unhealthy lifestyles could be catastrophic. Bad health not only impacts on the individual but also on the rest of the community. Diagnosis of the challenge is straightforward. The tougher question is what to do about reducing waistlines in a country where we traditionally do not like telling individuals what to do.

It is interesting to note that Mr Selbie does not ascribe to the Big Brother approach of ceaseless legislation and nannying. Rather, he is keen to promote choices – making the case passionately that people should be encouraged to embrace good health. One of his suggestions is that parents feed their children from smaller plates. That way the child can clear his or her plate, as ordered, without actually consuming too much. Like all good ideas, this is rooted in common sense.

(www.telegraph.co.uk. Adaptado.)

Segundo o texto, a diabetes a) deve ter suas causas - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

Every new piece of information about Britain’s weight problem makes for ever more depressing reading. Duncan Selbie, the Chief Executive of Public Health England, today tells us that by 2034 some six million Britons will suffer from diabetes. Of course, many people develop diabetes through no fault of their own. But Mr Selbie’s research concludes that if the levels of obesity returned to their 1994 levels, 1.7 million fewer people would suffer from the condition.

Given that fighting diabetes already drains the National Health Service (NHS) by more than £1.5 million, or 10 per cent of its budget for England, the impact upon the Treasury in 20 years’ time from unhealthy lifestyles could be catastrophic. Bad health not only impacts on the individual but also on the rest of the community. Diagnosis of the challenge is straightforward. The tougher question is what to do about reducing waistlines in a country where we traditionally do not like telling individuals what to do.

It is interesting to note that Mr Selbie does not ascribe to the Big Brother approach of ceaseless legislation and nannying. Rather, he is keen to promote choices – making the case passionately that people should be encouraged to embrace good health. One of his suggestions is that parents feed their children from smaller plates. That way the child can clear his or her plate, as ordered, without actually consuming too much. Like all good ideas, this is rooted in common sense.

(www.telegraph.co.uk. Adaptado.)

According to the information in the article, the situation - FGV 2014

Inglês - 2014AIRLINE COMPENSATION

By Susan Stellin

1 The day I was supposed to fly from London to Newark this spring, British Airways sent an e-mail saying the flight had been canceled. When I called to rebook, the British Airways agent offered a flight two hours earlier, which meant my boyfriend and I had to drop everything and race to Heathrow. The payoff came a month later, when the airline sent a check for $787 (300 euros each), compensation for our inconvenience.

2 Travelers on flights that are canceled or delayed must often accept whatever rebooking an airline offers, even if it means getting stranded at an airport for days. In the United States airlines aren’t required to compensate passengers on delayed or canceled flights, but it’s a different story in Europe. The payment that my boyfriend and I received was required by the European Union’s passenger rights law, EC 261, which obligates airlines to pay for a hotel room and meals if travelers are stranded because of a cancellation or delay.

3 If the problem is the airline’s fault — for instance, our cancellation was due to a malfunctioning plane — the carrier is supposed to compensate passengers up to 600 euros, based on the length of the flight and how long you’re delayed. I was surprised that we qualified since we actually got an earlier flight, but the law covers situations when passengers have little advance notice and have to change their plans.

4 EC 261 applies to any airline departing from the European Union — including American carriers — and European airlines flying to or from Europe. It was adopted in 2005; since then, similar rules have been extended to passengers traveling within Europe by rail, ship or bus.

5 In theory, the law gives travelers greater protection in Europe than in the United States. In practice, airlines on both sides of the Atlantic have resisted paying some of these benefits, and many passengers do not even know these rights exist. The e-mails British Airways sent me didn’t mention compensation, and neither did the agent I spoke with. I knew about the law so I found the information on the airline’s Internet site. But the claims process was easy, and British Airways paid quickly.

6 “You’re lucky you got your money,” said Dale Kidd, a spokesman for the European Commission. “Generally, it depends on the airline, but some are better than others at paying claims.” So which airlines are the worst offenders? “I’d prefer not to do naming and shaming,” Mr. Kidd said. “It depends a lot on the persistence of the victim making the claim.”

7 One reason airlines have resisted this regulation is disagreement over who should be responsible for stranded travelers when major disruptions occur — like the volcanic ash cloud that caused more than 100,000 flight cancellations in Europe in 2010. “The ash cloud went on for eight or nine days, so it’s probably unreasonable to expect a carrier to put you up at the Hilton for that length of time,” Mr. Kidd conceded. Indeed, the airline industry says carriers lost nearly $2 billion because of the cloud, including expenses for hotel bills, although some airlines refused to pay these claims.

Adapted from The International Herald Tribune, August 31 – September 1, 2013.

Segundo o texto, a pergunta apresentada no primeiro - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

According to McGill University neuroscientists, music - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

O texto relaciona a música às drogas porque ambas a) - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

No trecho do segundo parágrafo – which are connected - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

No trecho final do segundo parágrafo – As DJ Lee Haslam - UNIFESP 2014

Inglês - 2014No trecho final do segundo parágrafo – As DJ Lee Haslam

told us, music is the drug. –, é possível substituir a palavra as, sem alteração de sentido, por

Segundo as informações apresentadas no terceiro e - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

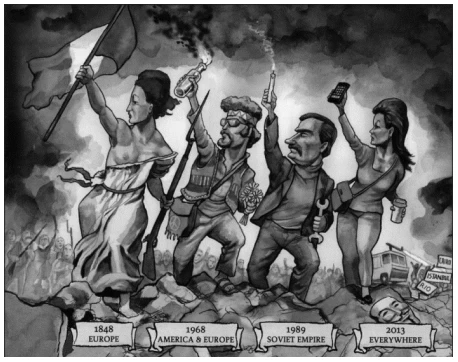

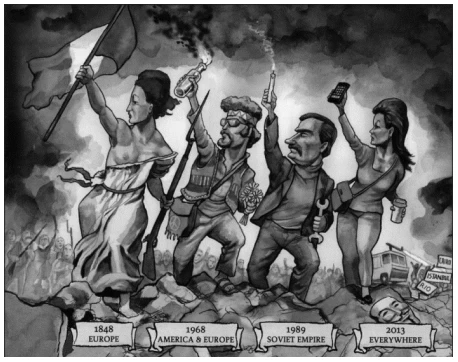

Segundo o texto, os protestos de 2013, em diversos - FUVEST 2014

Inglês - 2014

A wave of anger is sweeping the cities of the world.

The protests have many different origins. In Brazil people rose up against bus fares, in Turkey against a building project. Indonesians have rejected higher fuel prices. In the euro zone they march against austerity, and the Arab spring has become a perma-protest against pretty much everything.

Yet just as in 1848, 1968 and 1989, when people also found a collective voice, the demonstrators have much in common. In one country after another, protesters have risen up with bewildering speed. They tend to be ordinary, middle-class people, not lobbies with lists of demands. Their mix of revelry and rage condemns the corruption, inefficiency and arrogance of the folk in charge.

Nobody can know how 2013 will change the world – if at all. In 1989 the Soviet empire teetered and fell. But Marx’s belief that 1848 was the first wave of a proletarian revolution was confounded by decades of flourishing capitalism and 1968 did more to change sex than politics. Even now, though, the inchoate significance of 2013 is discernible. And for politicians who want to peddle the same old stuff, news is not good.

Ao comparar os protestos de 2013 com movimentos - FUVEST 2014

Inglês - 2014

A wave of anger is sweeping the cities of the world.

The protests have many different origins. In Brazil people rose up against bus fares, in Turkey against a building project. Indonesians have rejected higher fuel prices. In the euro zone they march against austerity, and the Arab spring has become a perma-protest against pretty much everything.

Yet just as in 1848, 1968 and 1989, when people also found a collective voice, the demonstrators have much in common. In one country after another, protesters have risen up with bewildering speed. They tend to be ordinary, middle-class people, not lobbies with lists of demands. Their mix of revelry and rage condemns the corruption, inefficiency and arrogance of the folk in charge.

Nobody can know how 2013 will change the world – if at all. In 1989 the Soviet empire teetered and fell. But Marx’s belief that 1848 was the first wave of a proletarian revolution was confounded by decades of flourishing capitalism and 1968 did more to change sex than politics. Even now, though, the inchoate significance of 2013 is discernible. And for politicians who want to peddle the same old stuff, news is not good.

No trecho do quarto parágrafo – However, we now have - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?